does doordash do quarterly taxes

DoorDash stock has declined by about 34 thus far in 2022 and remains down by over 60 from highs seen last November 2021. January 15 2021 was the deadline for quarterly payments on income earned from September 1 to December 31.

How Do I Calculate Quarterly Taxes Estimates For Doordash Grubhub Uber Eats Postmates And Other Gig Work Entrecourier

You are required to report and pay taxes on any income you receive.

. There isnt really a category of taxes for DoorDash but we know that a lot of Dashers refer to their tax responsibilities as DoorDash taxes so weve used that term. Understand how taxes work. The busiest of all but also the lowest paying.

The most important tools during tax season are TurboTax to file your taxes and a mileage tracking app to keep track of your miles. It does not provide for reimbursement of any taxes penalties or interest imposed by taxing authorities and does not include legal representation. Each tax year is divided into four payment periods.

Figure out taxable profit for the week. The time value of money -- the idea that money received in the present is more valuable than the same sum in the future because of its potential to be invested and earn interest -. Outside of the 1099-MISC you may need to file your estimated taxes quarterly if you will pay more than 1000 in taxes for the fiscal year.

HR Block tax software and online prices are ultimately determined at the time of print or e-file. How do Uber drivers pay taxes. Does DoorDash send you a w2.

Even if its just a basic understanding if you know what taxes are based on and how they are figured it demystifies the whole thing. There are two parts to this tax. Decide how you will save.

Knowing how many miles you drove means a smaller tax bill. Reply to me if you need more info on it. For drivers using Gridwise has even more advantages than ever before.

Its not as mysterious as it sounds. Post was informative on the mileagepay info on how you should accept or decline orders. All they have to do is instruct their employer by filling out tax form W-4 what percentage of income taxes to withhold from each paycheck-- and this is automatically done throughout the tax year.

One of the things a lot of new drivers for the best gig jobs and food delivery services overlook when theyre just getting started is taxes. Unilevers Major Operational Changes Hint at Divestment. Estimated expenses for the average DoorDash driver How Gridwise helps DoorDash drivers earn more How DoorDash pay is calculated DoorDash uses a cryptic black-box algorithm to create its pay model.

The W 2 form is usually mailed to you or made accessible online by the company you work for. I use 25 of my profit from step 2. Teens often send money to friends using popular person-to-person payment platforms like Venmo and PayPal.

In addition its a good idea to call the IRS if you dont receive the. One notable exception is when the 15th falls on a legal holiday or a weekend. How do Dashers pay taxes.

Income minus expenses dont forget mileage allowance. So each -- the quarterly cohort starting from 2019 all the way through to. First thing lets clarify.

If the form is lost missing or you cant find it online contact your employer immediately. Taxes Insurance Reviews Ratings Best Online Brokers Best Savings Accounts. All a W-2 employee typically has to do taxes-wise is to file their tax return for the tax year in the April of the following year -- and if they.

Get Your Taxes Done Right. So each dot on the chart is a quarterly cohort. On top of tracking and calculating your earnings and mileage we collect earnings and mileage figures anonymously of course from all our drivers and analyze those numbers to figure out how well everybody is doing.

Estimated taxes are paid quarterly usually on the 15th day of April June September and January of the following year. Income tax expense was 984 million representing a 188 effective tax rate for the 12 weeks ended December 4 2021. How much DoorDash drivers make in 2021.

How Do You File Taxes For Doordash. If Doordash doesnt do this or do it well then its up to you. DoorDash does not take out withholding tax for you.

Even if you. Dashers should make estimated tax payments each quarter. Apple Trending Lower as Quarterly Report Approaches.

Taxes as an independent. Income tax expense was 295 million representing a 193 effective tax rate for the 12 weeks ended December 5 2020. When are quarterly taxes due in 2021.

Additional terms and restrictions apply. As an independent contractor you can knock the standard mileage deduction of 56 cents per mile 2021 or 585 cents in 2022 from your revenue. Remember to pay the iRS quarterly taxes.

16 2022 GLOBE NEWSWIRE -- The board of directors of CF Financial Corporation NASDAQCFFI has declared a regular cash dividend of 40 cents per share which is payable April 1. In fact the stock now trades below its IPO price of 102 per share. Dashing can be a career.

Doordash only sends 1099 forms to dashers who make 600 or more in the past year. Essentially if a customer doesnt give a decent tip it wont be worth doing the delivery. Doordash does not track mileage for you.

The decrease in the effective income tax rate was primarily driven by incremental discrete state. If thinking about all that paperwork keeps you up at night a qualified tax pro can help. Youll make 200-300 a day easily.

If Dashing is a small portion of your income you may be able to increase your income tax withholding at your day job instead of paying quarterly taxes. Whether youre new to DoorDash taxes or have a few tax filings under your belt HR Block is here to help Dashers navigate tax time. Stick to hours ranging from 10-3pm and 5-10pm.

Income on this platform is a 5050 split between base and tips. All 1099 employees pay a 153 self-employment tax. My acceptance rate is always under 50 but im making bank so who cares.

If rideshare driving is a small portion of your income you may be able to increase your income tax withholding at your day job instead of making quarterly payments. See Free In-person Audit Support for complete details. How much do DoorDash Drivers earn.

Thats important to know. But new tax laws for 2022 could make these transactions trickier from a tax perspective. Do I have to file taxes for DoorDash if I made less than 600.

What To Do If You Cant Find Your W 2 Form. Uber does not take out withholding tax for you. TOANO Va Feb.

Rideshare drivers should make estimated tax payments each quarter. How DoorDash pay is calculated in 2021. And if you want to use a Turbotax alternative then check out HR Block.

Working as an independent contractor adds another level of difficulty to preparing your taxes especially if you have to file quarterly or receive multiple 1099-NECs. Do I have to pay taxes if I made less than 600 with Doordash.

Doordash 1099 Taxes Your Guide To Forms Write Offs And More

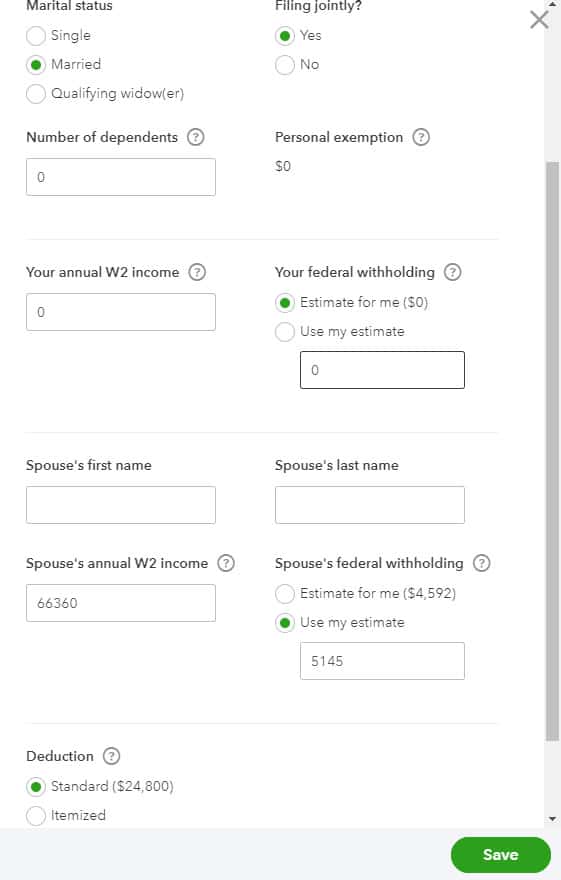

Quarterly Tax Payment For Doordash Grubhub Drivers Entrecourier

Creating The Perfect Expense Report In 2021 Downloadable Templates Templates Work Organization

Enjoy All The Benefits Of A Tax Professional With Xpert Taxes Get Matched With A Tax Expert Who Is Knowledgea Tax Prep Organizing Time Receipt Organization

Doordash Taxes Made Easy Ultimate Dasher S Guide Ageras

How Do I Calculate Quarterly Taxes Estimates For Doordash Grubhub Uber Eats Postmates And Other Gig Work Entrecourier

Doordash 1099 Taxes Your Guide To Forms Write Offs And More